Wednesday, 17 February 2016

Interest Rates of Small Saving Schemes to be recalibrated w.e.f. 1.4.2016 on a Quarterly Basis

Interest Rates of Small Saving Schemes to be recalibrated w.e.f. 1.4.2016 on a Quarterly Basis to align the small saving interest rates with the market rates of the relevant Government securities;

Interest rate on savings schemes based on laudable Social Development or Social Security Goals including Sukanya Samriddhi Yojana, the Senior Citizen Savings Scheme and the Monthly Income Scheme left untouched by the Government.

The National Savings Schemes (NSSs) regulated by the Ministry of Finance offer complete security of investment combined with high attractive returns. These schemes also act as instruments of financial inclusion especially in the geographically inaccessible areas due to their implementation primarily through the Post Offices, which have reach far and wide.

The small savings interest rates are perceived to limit the banking sector’s ability to lower deposit rates in response to the monetary policy of the Reserve Bank of India. In the context of easing the transmission of the lower interest rates in the economy, the Government also has to take a comprehensive view on the social goals of certain National Small Savings Schemes. Accordingly, it has been decided that the following shall be implemented with effect from 1.4.2016 with regard to National Savings Schemes:

1. The Sukanya Samriddhi Yojana, the Senior Citizen Savings Scheme and the Monthly Income Scheme are savings schemes based on laudable social development or social security goals. Hence, the interest rate and spread that these schemes enjoy over the G-sec rate of comparable maturity viz., of 75 bps, 100 bps and 25 bps respectively have been left untouched by the Government.

2. Similarly the spread of 25 bps that long term instruments, such as the 5 yr Term Deposit, 5 year National Saving Certificates and Public Provident Fund (PPF) currently enjoy over G-Sec of comparable maturity, have been left untouched as these schemes are particularly relevant to the self-employed professional and salaried classes. This will encourage long term savings.

3. The 25 bps spread that 1 yr., 2yr. and 3 yr. term deposits, KVPs and 5 yr Recurring Deposits have over comparable tenure Government securities, shall stand removed w.e.f. April 1, 2016 to make them closer in interest rates to the similar instruments of the banking sector. This is expected to help the economy move to a lower overall interest rate regime eventually and thereby help all, particularly low-income and salaried classes.

4. The interest rates of all small saving schemes would be recalibrated w.e.f. 1.4.2016 on a quarterly basis as given under, to align the small saving interest rates with the market rates of the relevant Government securities;

Sr. No.

|

Quarter for which rate of interest would be effective

|

Date on which the revision would be notified

|

Rate of interest to be based on FIMMDA month end G-Sec. rate pertaining to

|

1.

|

April to June

|

15th March

|

Dec.-Jan.-Feb.

|

2.

|

July to September

|

15th June

|

Mar.-Apr.-May.

|

3.

|

October to December

|

15th September

|

Jun.-Jul.-Aug.

|

4.

|

January to March

|

15th December

|

Sep.-Oct.-Nov.

|

5. The compounding of interest which is biannual in the case of 10 yr National Saving Certificate (discontinued since 20-12-2015), 5 yr National Saving Certificate and Kisan Vikas Patra, shall be done on an annual basis from 1.4.16.

6. Premature closure of PPF accounts shall be permitted in genuine cases, such as cases of serious ailment, higher education of children etc,. This shall be permitted with a penalty of 1% reduction in interest payable on the whole deposit and only for the accounts having completed five years from the date of opening.

7. In pursuance to the decision as mentioned in Para 4 above, the rates of interest applicable on various small savings schemes for the quarter from April to June 2016 effective from 1.4.2016 would be notified in March, 2016.

The above changes have been brought with the objective of making the operation of National Saving Schemes market-oriented in the interest of overall economic growth of the country, even while protecting their social objectives and promoting long term savings.

Finance Ministry invites NJCA to discuss over 7th Pay commission recommendations on 19.2.2016

The Official Sources Close to the Finance Ministry told that a Meeting with National Joint Council of Action to be held on 19th February 2016 on the issues of 7th Pay Commission and Charter of Demands of NJCA.

It is informed that Convener, 7th Pay Commission Implementation Cell has fixed Meeting with NJCA on 19th February 2016 at North Block to discuss about the matters pertaining to 7th CPC recommendations and Charter of Demands of NJCA. The timing of the meeting scheduled itself has reveals its importance.

It is expected that, since the Meeting is scheduled before the Budget Session, some news about implementation of 7th pay commission may be announced in Budget or at least we are able to know the latest development about 7th cpc implementation after the Meeting.

An internal meeting of NJCA will also be held on 18.2.2015 before they attend the meeting with Finance Ministry.

Monday, 25 January 2016

Wednesday, 20 January 2016

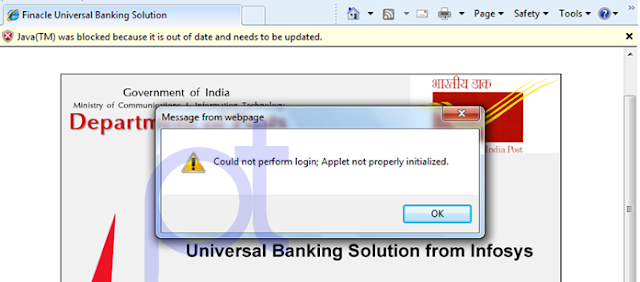

COULD NOT PERFORM LOGIN; APPLET NOT PROPERLY INITIALIZED IN DOP FINACLE

COULD NOT PERFORM LOGIN; APPLET NOT PROPERLY INITIALIZED IN DOP FINACLE

Java applet not properly initialized in Internet Explorer and could not perform login request in DOP finacle. The above issues are not related to Finacle Server it is a purely Finacle desktop configuration issues. Please check the Java settings for accessing Finacle Application.

Do the following to enable JAVA applet in IE Browser

Open Internet explorer

Tools-->Manage Add-ons

Under Oracle America, Inc following three options should be enabled.

1.Java(tm) Plug-In SSV Helper

2.Java(tm) Plug-In 2 SSV Helper

3.Sun Java Console

Saturday, 16 January 2016

ABOUT RURAL ICT FOR GRAMIN DAK SEWAKS

|

| HAND HELD DEVICE |

- Electronic transactions- Booking and delivery of Speed Post, registered mail, money orders, sale of stamps and postal stationery will be done through these devices and paper receipt shall be generated

- instantaneously thereby eliminating chances of overcharging and other problems associated with manual transactions. Savings Bank deposits & withdrawals, PLI/RPLI premium deposits and loan/claim payments will also be done electronically on these devices.

- Immediate uploading of transaction data and financial reconciliation- Using mobile connectivity, data pertaining to all transactions done on the hand-held devices shall be uploaded onto the central server. E-Money order will reach the destination post office instantaneously unlike present day where the money order is digitized at the nearest computerized Post Office and leads to delay in delivery. All financial transactions shall also be reconciled immediately without any manual intervention and Cash on Delivery amount collected in the village shall be immediately credited to the account of e-Commerce Company. Similarly the artisans would be able to fulfill e-commerce orders and receive immediate payment for their sold products online. This will have a positive impact on the overall economy of the villages.

- Automatic track and trace- Speed Post and Registered letters/parcels and money remittances will be trackable at the Branch Post Office level and booking/delivery information will also be uploaded to central server immediately.

- Fraud and leakage elimination- As Savings Bank and Postal Life Insurance transactions will be done on a real-time basis and through immediate generation of receipt and voice message, chances of fraud would be eliminated. Biometric authentication of MNREGS and social security beneficiaries at the time of pay-out would also reduce leakage in the schemes

- Post Offices as Common Service Centres- Branch Post Offices shall be able to work as Common Service Centres and offer services such as Railway Reservation, online bill payment for electricity and water utilities, mobile and DTH recharge, insurance policy premium payments & transactions for partner banks/insurance companies/mutual funds etc

Saturday, 9 January 2016

ALL THE OFFICES WILL MIGRATE BY 2ND WEEK OF MARCH 2016 !!!

CBS Video Conference Dated 08.01.2016

Click the image to view the latest update on CBS rollout, installation of ATMs etc.

The Payment of Bonus (Amendment) Bill, 2015 notified:Increase in the Eligibility Limit under clause (13) of Section 2 and Calculation Ceiling under Section 12 of the Payment of Bonus Act, 2015

The Payment of Bonus (Amendment) Bill, 2015 was passed by the Parliament in the just concluded Winter Session of the Parliament. The Payment of Bonus (Amendment) Act, 2015 has been published in the Gazette of India, Extraordinary on 1st January, 2016 as Act No. 6 of 2016. The provisions of the Payment of Bonus (Amendment) Act, 2015 shall be deemed to have come into force on the 1st day of April, 2014.The Payment of Bonus (Amendment) Act, 2015 envisages enhancement of eligibility limit under section 2(13) from Rs.10,000/- per month to Rs.21,000/- per month and Calculation Ceiling under section 12 from Rs. 3500 to Rs.7000 or the minimum wage for the scheduled employment, as fixed by the appropriate Government, whichever is higher. The Payment of Bonus (Amendment) Act, 2015 also mandates previous publication of draft subordinate legislations, framed under the enabling provisions under the said Act, in the Official Gazette for inviting objections and suggestions before their final notification.

The Government has been receiving representations from trade unions for removal of all ceilings under the Payment of Bonus Act, 1965. It is also one of the demands made by them during the country-wide General Strike held in February, 2013 and September, 2015. As the last revision in these two ceilings were made in the year 2007 and was made effective from the 1st April, 2006, it was decided by the Government to make appropriate amendments to the Payment of Bonus Act, 1965.

These changes in the Payment of Bonus Act, 1965 will benefit thousands of work force.

The Government has been receiving representations from trade unions for removal of all ceilings under the Payment of Bonus Act, 1965. It is also one of the demands made by them during the country-wide General Strike held in February, 2013 and September, 2015. As the last revision in these two ceilings were made in the year 2007 and was made effective from the 1st April, 2006, it was decided by the Government to make appropriate amendments to the Payment of Bonus Act, 1965.

These changes in the Payment of Bonus Act, 1965 will benefit thousands of work force.

Friday, 1 January 2016

Thursday, 31 December 2015

Tuesday, 22 December 2015

DON'T TAKE LEAVE ON 01/01/2016

Central Government employees are wondering if there will be any consequences of taking leave on January 1, 2016, the date of implementation of the 7th Pay Commission report.

The recommendations of the 7th Pay Commission regarding the salaries and perks for the Central Government employees will come into effect from January 1, 2016 onwards. Many are curious to find out the connection between the date of implementation of 7th CPC and reporting to work on the day.

Normally, the date of joining work, date of getting the promotion, date of receiving the increments, transfer date, and retirement dates are very important for a Central Government employee. In the average service period of a Central Government employee, he/she is likely to witness two or three Pay Commissions. Keeping this in mind, it would be better to not absent oneself on January 1, 2016.

“All Central Government employees are advised to report to work on January 1, 2016 (Friday).”

“This is especially so for those who are on long leave. It will help them avoid a lot of problems in future.”

“If 01.01.2016 is announced as a holiday, it will be better to report to work the next day.”

If the recommendations of the 7th Pay Commission are going to be implemented from 01.01.2016 onwards, then the employees will have to come to work that day to accept these recommendations. If he/she is absent on the day, then the day they return to work will be treated as the day they had accepted the new recommendations.

If an employee not to report on the date of implementation of recommendations of new pay commission, this could delay the benefits of the 7th Pay Commission. This could also cause financial losses too due to pay revision as per the recommendations of new pay commission.

According to rules, in order to qualify for the annual increment, an employee has completed 6 months or more in the revised pay structure as per 6th CPC, as on 1st July. A delay of even a single day could deny you an increment, as per the rule.

It is not easy to calculate the date of promotion for Central Government employees. Normally, promotions are granted with retrospective effect. Let us assume that the promotion was given with effect from 01.01.2016. Not reporting to work on that day could cause a number of problems.

Since the government rules are bound to be changed arbitrarily, one can never be sure of the kind of troubles it could cause them. Therefore, it is better to go to work on 01.01.2016.

The recommendations of the 6th Pay Commission were implemented on 01.01.2006, a Sunday. Therefore, the next day was taken as the assumption date. One might remember that the government had issued another order to avoid the confusions that resulted due to this.

Even those who are on long leave for any particular reason are advised to report to work on January 1, 2016 at least and then continue with their leave. This will help them avoid a lot of problems.

Saturday, 19 December 2015

“The Prime Minister Narendra Modi thinks workers should be treated with the stick,” alleged Rahul Gandhi.

Rahul Gandhi said the Prime Minister thinks that Indian government employees and workers are shirkers as he lambasted the government for attempting to dilute labour laws.

“Like we fought for the rights of farmers, we will fight for the cause of the workers and government employees and stand with them and would not retreat an inch. We will fight BJP, Modi and RSS,” he said amid applause at the 31st Plenary Session of INTUC, the trade union wing of the Congress.

“Prime Minister thinks that the government employees and workers of India are dishonest, work shirkers and could be made to work only by wielding a lathi. He feels labour laws have to be weakened and workers disciplined so that they are forced to work. He wants to bring them on their knees. If you look at the new laws being made in Gujarat, Rajasthan and Haryana, it will become clear that Modi has started a big assault on workers,” he added.

Gandhi said, “I do not agree that our employee or worker is either shirker or indisciplined… Our worker is scared. He is scared of his future, the future of his children. The worker is scared whether the job he has today will be there tomorrow. Will the factory gate open for him tomorrow.”

Insisting that the government should become “judge” between the labourers and the industry and “not advocate” of industry, he told the Prime Minister that if he is able to remove fear from the mind of the workers then India would be able to surpass China in no time.

Rahul also said the PM was merely creating buzzwords. “It started with ‘achche din’, then came ‘Swachch Bharat’, ‘Smart Cities’, ‘Make in India’, ‘Digital India’ and now ‘Accessible India’. God knows which jumla will come out next.”

Rahul Gandhi was accompanied by former prime minister Manmohan Singh and several Congress leaders.

“Like we fought for the rights of farmers, we will fight for the cause of the workers and government employees and stand with them and would not retreat an inch. We will fight BJP, Modi and RSS,” he said amid applause at the 31st Plenary Session of INTUC, the trade union wing of the Congress.

“Prime Minister thinks that the government employees and workers of India are dishonest, work shirkers and could be made to work only by wielding a lathi. He feels labour laws have to be weakened and workers disciplined so that they are forced to work. He wants to bring them on their knees. If you look at the new laws being made in Gujarat, Rajasthan and Haryana, it will become clear that Modi has started a big assault on workers,” he added.

Gandhi said, “I do not agree that our employee or worker is either shirker or indisciplined… Our worker is scared. He is scared of his future, the future of his children. The worker is scared whether the job he has today will be there tomorrow. Will the factory gate open for him tomorrow.”

Insisting that the government should become “judge” between the labourers and the industry and “not advocate” of industry, he told the Prime Minister that if he is able to remove fear from the mind of the workers then India would be able to surpass China in no time.

Rahul also said the PM was merely creating buzzwords. “It started with ‘achche din’, then came ‘Swachch Bharat’, ‘Smart Cities’, ‘Make in India’, ‘Digital India’ and now ‘Accessible India’. God knows which jumla will come out next.”

Rahul Gandhi was accompanied by former prime minister Manmohan Singh and several Congress leaders.

DIVISIONAL SECRETARY WROTE A LETTER REGARDING VICTIMISATION/HARASSMENT IN THE NAME OF MODERNISATION

FNPO

NATIONAL

ASSOCIATION OF POSTAL EMPLOYEES,Gr-C

To

The Circle Secretary

NAPE,Gr C, Odisha

Sub:- Stop Victimisation /Harassment to officials in the name of CBS and McCamish

Sir,

The following issues may be take-up with

the Circle authorities for its early settlement

- In violation of labour act, the System Administrators are asked to work continuously throughout day and night in the name of CBS migration of a particular office to be completed within a stipulated time. Neither they are financially benefited nor in the lieu of their hard work are they not provided to avail suitable off. Thereby they are harassed and frustrated to work.

- Initially the singlehanded offices without Sanchaypost package. But all of a sudden in the name of CBS basing on data fed by Infosys which is full of error,/HOSB data were migrated for which official working at the bottom level are crying.

- Since the data has been migrated without balance agreement, proper checking, and customers facing officials being abused and threatened by the customers. There is every chances of huge for in future.

- Sify connectivity is not working properly for which officials are forced to detain and to discharge their duties after office hours most of the days.

- It is learnt that, CBS central server seems unresponsive most of the days, for which officials facing unnecessary public pressure.

- Offices have not been provided with proper infrastructure like LaserJet printers, compatible systems for CBS.

- . 256 KBPS bandwith is not enough for SOs and needs to be upgraded for Finacle and McCamish.

- Most of offices are running with NSP2 connectivity which needs to be equipped with NSP1 before migration.

- KLC gap has not yet been fully settled which compels to collect the premium through point of sale. But in Meghdoot 7.9.4 version, there is no provision for premium collection in McCamish rolled out offices. There by the customers are refused by the counter assistants. Being refused by the counter assistant, customer don’t forget to man handled the officials.

- . Adequate man power and infrastructure are not been provided, thereby rebooking of rpli transactions at account office is not possible on the part of existing man power.

Administrations only

wants to implement new packages ignoring practical problems faced by the grass

root level employees. Immediately suitable steps may kindly be taken by the

authority.

Gobinda Chandra Pratihari

NAPE, Gr- C, PURI

Tuesday, 15 December 2015

Subscribe to:

Posts

(

Atom

)