Tuesday, 29 March 2016

Tuesday, 22 March 2016

REVIEW ABOUT DOP FINACLE

Why Finacle is always getting slow/hanging/not responding properly.

Reasons may be the following:

- Web server traffic limit exceeding( for example My mobile has a web server called Bitweb. it will be efficient for client--server web applications. But it's traffic limit is 999. It means when more than 999 people uses that web application automatically my server hangs and it doesn't respond until the administrator clears the traffic queues. The same may be happening in our finacle)

- Network issues( i.e. server should be able to output the data with high bandwidth speed to clients. If the network issue is from client only the sufferer clients will face issue. But all clients facing same issue.. so the network issue is from Server only.

- Bandwidth Speed( First of all server configured with high speed of bandwidth. Suppose My server configured with 1mbps speed, but the clients having 4mbps bandwidth for access of web application then they will only able to get out from my server is 1mbps. if the number of users is 100. then the speed devided to 100 i.e. 1024/100=10.24 kbps speed response only you will get from server. The same may be happening in Finacle.)

- Clients having only 256kbps speed of network ( But it may be false. Because we have own WAN network with SIFY, and the server has to be capable to serve clients efficiently effectively and speedily. So the client speed is not big issue with best of my knowledge)

Actually Infosys team said that 100kbps speed is sufficient for clients.

But it's their lack of knowledge of DOP Transactions flow, DOP strength in work load.

Overall my review about finacle is, " A review should be conducted with the team who are running server and with the DOP employees and administrative staff..No bank is suffering like our Finacle though it has been using in 84 countries and about 154+ clients.

But the joke is, in their website they mentioned some of major banks like SBI,PNB,RCBC,KMB etc DOP is not in their clients list though they bags 600cr project from DOP which is a big project than other clients.

7TH PAY COMMISSION ENHANCED SALARIES, ARREARS TO BE PAID IN JULY

New Delhi: The central government is going to start payment of salaries and pensions to its 48 lakh employees and 52 lakh pensioners according to the 7th Pay Commission recommendations from July along with six months’ arrears.

The Seventh Pay Commission report was presented to Finance Minister Arun Jaitley in November.

The payments will be made following the pay-fixation method in the new pay matrix which has been suggested in place of pay band and grade pay by the Seventh Pay Commission.

The government’s overall arrears payout will be lower because of only six months arrears this time, compared to the previous pay commission, which came in late.

The government has been provisioned Rs 70,000 crore in the Union Budget 2016-17 to meet the demand for the new pay commission award that will be made effective from January 2016.

Basic salary of central government employee will almost be 30 percent hiked under the new pay commission award with employees in the lower rung are likely to get the highest percentage of raise.

“We’re at the final stage for issuing the notification and 3-4 more months will be required to implement, so we hopefully say that they will get new pay and arrears in the July,” a source close to the developments told The Sen Times.

The report of the Seventh Pay Commission was presented to Finance Minister Arun Jaitley in November with a recommendation for raising minimum pay to Rs 18,000 per month from current Rs 7,000 while the maximum pay, drawn by the Cabinet Secretary, has been fixed at Rs 2.5 lakh per month from current Rs 90,000.

The panel recommended a 14.27 per cent increase in basic pay. The overall increase in salary, allowances and pensions is 23.55%. The increase in allowances will be higher by 63% while pensions will rise 24%.

The government set up a 13-member Empowered Committee of Secretaries (CoS) headed by Cabinet Secretary P K Sinha for processing the report of the Seventh Pay Commission before cabinet nod.

An Implementation Cell has been created in the Finance Ministry which works as the Secretariat of the Empowered Committee. All central government employees unions’ submitted their written demands in respect of seventh pay commission’s anomalies in the cell to review, which are under process.

Sunday, 20 March 2016

Wednesday, 17 February 2016

Interest Rates of Small Saving Schemes to be recalibrated w.e.f. 1.4.2016 on a Quarterly Basis

Interest Rates of Small Saving Schemes to be recalibrated w.e.f. 1.4.2016 on a Quarterly Basis to align the small saving interest rates with the market rates of the relevant Government securities;

Interest rate on savings schemes based on laudable Social Development or Social Security Goals including Sukanya Samriddhi Yojana, the Senior Citizen Savings Scheme and the Monthly Income Scheme left untouched by the Government.

The National Savings Schemes (NSSs) regulated by the Ministry of Finance offer complete security of investment combined with high attractive returns. These schemes also act as instruments of financial inclusion especially in the geographically inaccessible areas due to their implementation primarily through the Post Offices, which have reach far and wide.

The small savings interest rates are perceived to limit the banking sector’s ability to lower deposit rates in response to the monetary policy of the Reserve Bank of India. In the context of easing the transmission of the lower interest rates in the economy, the Government also has to take a comprehensive view on the social goals of certain National Small Savings Schemes. Accordingly, it has been decided that the following shall be implemented with effect from 1.4.2016 with regard to National Savings Schemes:

1. The Sukanya Samriddhi Yojana, the Senior Citizen Savings Scheme and the Monthly Income Scheme are savings schemes based on laudable social development or social security goals. Hence, the interest rate and spread that these schemes enjoy over the G-sec rate of comparable maturity viz., of 75 bps, 100 bps and 25 bps respectively have been left untouched by the Government.

2. Similarly the spread of 25 bps that long term instruments, such as the 5 yr Term Deposit, 5 year National Saving Certificates and Public Provident Fund (PPF) currently enjoy over G-Sec of comparable maturity, have been left untouched as these schemes are particularly relevant to the self-employed professional and salaried classes. This will encourage long term savings.

3. The 25 bps spread that 1 yr., 2yr. and 3 yr. term deposits, KVPs and 5 yr Recurring Deposits have over comparable tenure Government securities, shall stand removed w.e.f. April 1, 2016 to make them closer in interest rates to the similar instruments of the banking sector. This is expected to help the economy move to a lower overall interest rate regime eventually and thereby help all, particularly low-income and salaried classes.

4. The interest rates of all small saving schemes would be recalibrated w.e.f. 1.4.2016 on a quarterly basis as given under, to align the small saving interest rates with the market rates of the relevant Government securities;

Sr. No.

|

Quarter for which rate of interest would be effective

|

Date on which the revision would be notified

|

Rate of interest to be based on FIMMDA month end G-Sec. rate pertaining to

|

1.

|

April to June

|

15th March

|

Dec.-Jan.-Feb.

|

2.

|

July to September

|

15th June

|

Mar.-Apr.-May.

|

3.

|

October to December

|

15th September

|

Jun.-Jul.-Aug.

|

4.

|

January to March

|

15th December

|

Sep.-Oct.-Nov.

|

5. The compounding of interest which is biannual in the case of 10 yr National Saving Certificate (discontinued since 20-12-2015), 5 yr National Saving Certificate and Kisan Vikas Patra, shall be done on an annual basis from 1.4.16.

6. Premature closure of PPF accounts shall be permitted in genuine cases, such as cases of serious ailment, higher education of children etc,. This shall be permitted with a penalty of 1% reduction in interest payable on the whole deposit and only for the accounts having completed five years from the date of opening.

7. In pursuance to the decision as mentioned in Para 4 above, the rates of interest applicable on various small savings schemes for the quarter from April to June 2016 effective from 1.4.2016 would be notified in March, 2016.

The above changes have been brought with the objective of making the operation of National Saving Schemes market-oriented in the interest of overall economic growth of the country, even while protecting their social objectives and promoting long term savings.

Finance Ministry invites NJCA to discuss over 7th Pay commission recommendations on 19.2.2016

The Official Sources Close to the Finance Ministry told that a Meeting with National Joint Council of Action to be held on 19th February 2016 on the issues of 7th Pay Commission and Charter of Demands of NJCA.

It is informed that Convener, 7th Pay Commission Implementation Cell has fixed Meeting with NJCA on 19th February 2016 at North Block to discuss about the matters pertaining to 7th CPC recommendations and Charter of Demands of NJCA. The timing of the meeting scheduled itself has reveals its importance.

It is expected that, since the Meeting is scheduled before the Budget Session, some news about implementation of 7th pay commission may be announced in Budget or at least we are able to know the latest development about 7th cpc implementation after the Meeting.

An internal meeting of NJCA will also be held on 18.2.2015 before they attend the meeting with Finance Ministry.

Monday, 25 January 2016

Wednesday, 20 January 2016

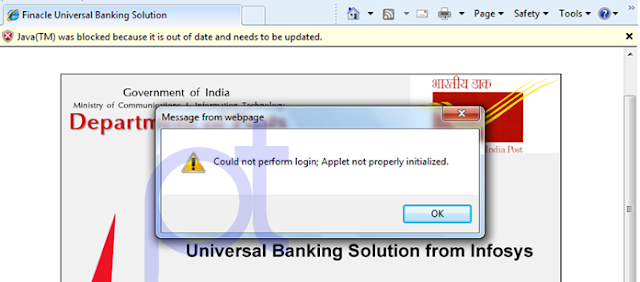

COULD NOT PERFORM LOGIN; APPLET NOT PROPERLY INITIALIZED IN DOP FINACLE

COULD NOT PERFORM LOGIN; APPLET NOT PROPERLY INITIALIZED IN DOP FINACLE

Java applet not properly initialized in Internet Explorer and could not perform login request in DOP finacle. The above issues are not related to Finacle Server it is a purely Finacle desktop configuration issues. Please check the Java settings for accessing Finacle Application.

Do the following to enable JAVA applet in IE Browser

Open Internet explorer

Tools-->Manage Add-ons

Under Oracle America, Inc following three options should be enabled.

1.Java(tm) Plug-In SSV Helper

2.Java(tm) Plug-In 2 SSV Helper

3.Sun Java Console

Saturday, 16 January 2016

ABOUT RURAL ICT FOR GRAMIN DAK SEWAKS

|

| HAND HELD DEVICE |

- Electronic transactions- Booking and delivery of Speed Post, registered mail, money orders, sale of stamps and postal stationery will be done through these devices and paper receipt shall be generated

- instantaneously thereby eliminating chances of overcharging and other problems associated with manual transactions. Savings Bank deposits & withdrawals, PLI/RPLI premium deposits and loan/claim payments will also be done electronically on these devices.

- Immediate uploading of transaction data and financial reconciliation- Using mobile connectivity, data pertaining to all transactions done on the hand-held devices shall be uploaded onto the central server. E-Money order will reach the destination post office instantaneously unlike present day where the money order is digitized at the nearest computerized Post Office and leads to delay in delivery. All financial transactions shall also be reconciled immediately without any manual intervention and Cash on Delivery amount collected in the village shall be immediately credited to the account of e-Commerce Company. Similarly the artisans would be able to fulfill e-commerce orders and receive immediate payment for their sold products online. This will have a positive impact on the overall economy of the villages.

- Automatic track and trace- Speed Post and Registered letters/parcels and money remittances will be trackable at the Branch Post Office level and booking/delivery information will also be uploaded to central server immediately.

- Fraud and leakage elimination- As Savings Bank and Postal Life Insurance transactions will be done on a real-time basis and through immediate generation of receipt and voice message, chances of fraud would be eliminated. Biometric authentication of MNREGS and social security beneficiaries at the time of pay-out would also reduce leakage in the schemes

- Post Offices as Common Service Centres- Branch Post Offices shall be able to work as Common Service Centres and offer services such as Railway Reservation, online bill payment for electricity and water utilities, mobile and DTH recharge, insurance policy premium payments & transactions for partner banks/insurance companies/mutual funds etc

Subscribe to:

Posts

(

Atom

)